The future of lease accounting: new standards and your fleet

FinanceNew lease accounting standards came into play worldwide from 1 January 2019.

Why the changes?

International accounting boards want more financial statement comparability and transparency for investors and other readers of financial statements.

The way it was

Operating leases were sometimes described as ‘off-balance-sheet financing’. This is because, under historical accounting standards, companies financing their assets with operating leases didn’t have to include those assets, or corresponding debt, on their balance sheet.

Many people began to suggest that not showing operating leases on balance sheets made companies’ gearing and borrowing ratios look unrealistically good. As a result, accounting boards demanded greater comparability and transparency about leverage and assets.

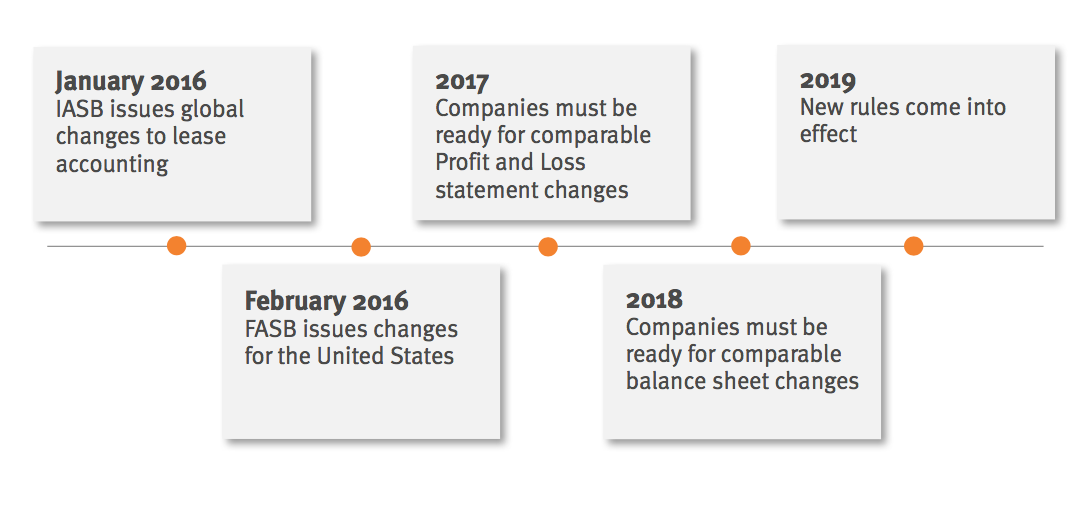

After more than a decade of discussions, the International Financial Reporting Standards (IFRS) – and the Financial Accounting Standards Board (FASB), its US equivalent – issued new standards in 2016 known as IFRS 16.

The timeline for new lease accounting standards

What does this mean for your business?

As of January 1st, 2019, off-balance sheet accounting for leases is no longer acceptable.

From that date, all leases with a term greater than 12 months on assets with a value over $5,000 — both finance and operating — must be included on the balance sheet.

Lessees should:

- Recognise right-of-use assets and lease liabilities on their balance sheet. (The asset is then reduced via depreciation charges and the liability is reduced by the principal component of lease payments.)

- Separate service components, like fuel and maintenance, from lease payments and record them as expenses.

Over the full lease term, the cumulative effect on the net profit is the same. But now related costs are spread over time and your statement of comprehensive income will change.

This means that in most cases IFRS16 should have a positive impact on a lessee’s EBITDA.

What is the impact on your cashflow?

No impact. Your cashflow is unaffected.

What impact will new lease accounting standards have across the world?

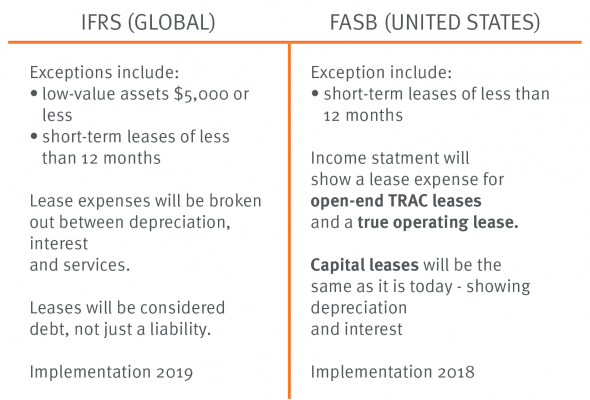

Despite best efforts, the same standard does not apply across the world. Accounting standards have changed worldwide. But there are slight differences between IFRS 16 and FASB approaches.

New Zealand companies that have to report under the US GAAP, like subsidiaries of US-based companies, need to understand the FASB requirements.

Differences between IFRS 16 (Global) and FASB (USA)

Does leasing still offer benefits?

In short: yes. Even after IFRS 16, leasing offers benefits. It’s a great way to spread the cost of assets and keep cash in your business.

Other benefits include:

- Easier budgeting and forecasting — predictable mobility costs

- Improved liquidity — capital isn’t tied up in vehicles

- Limited maintenance and residual value risk

- Operational flexibility — revise your mobility resources around the scale and focus of your organisation easily with leasing

- Efficient fleet administration and maintenance

- Efficient management of other services like communication, roadside assistance and driver services, etc.

What do fleet managers need to do about the change?

Fleet professionals need to work closely with your finance teams on this one. Ensure you meet new lease accounting standards by asking these key questions:

- Have you and your finance team identified fleet data required for IFRS reporting, including historical data required for comparison purposes?

- Have you put processes and systems in place for reporting on any type of lease in advance of the changes?

- Have you ensured your fleet provider can give you the necessary data to comply with the new standards? (Specifically: the split of lease rental between lease and non-lease [i.e. service] components.)

- Have you sought guidance from external auditors, as the rules are defined and interpreted? Remember: your auditors will determine your balance sheet reporting.

Want more information or assistance?

A SG Fleet/ LeasePlan expert is just a phone call away. They will happily help you understand what these new lease accounting standards mean to your fleet operations. Contact us.

Driving Insights

Driving Insights